Seasonal Commodity Statistics for September

August 24, 2012 Leave a comment

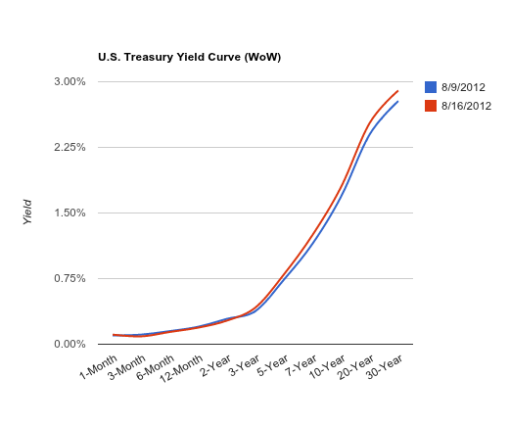

Stocks typically sell off in mid-september with 30-year treasuries rising as money flows out of the stock market into safer securities.

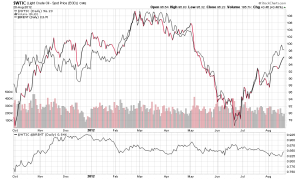

Crude oil makes seasonal highs and begins to decline during this month as summer travelers reduce gas consumption and the hurricane season is officially over. Hurricane season typically disrupts oil production in the Gulf of Mexico. Also, as temperatures start to shift cooler, refineries start to focus on producing heating oil instead of gasoline.

Copper prices start to fall as the construction season ends and typically remain on a downtrend through December. Silver on the other hand typically starts to rally in September as demand rises. Jewelers start to buy silver in preparation for the holiday season. Also, farmers in India are known to buy precious metals after their harvest which ends through september.

This year Soybeans and grains are very strong due to drought conditions across large parts of the United States. Historically, soybeans are in a weak period during September, reaching their seasonal lows in October when the harvest is over. Corn is typically in a downtrend, although a frost scare can cause price spikes.

Meat prices, such as live cattle tend to rise as the demand for cattle rises in the Fall. Typically people eat more meat as temperatures cool off. Government programs such as school lunches also increase demand as school is back in session.

In the past 12 years, the Euro has rallied 11 times from Labor Day through the end of the month. I am not sure if this year will go with the historical trend, however a Euro rally before the election could be expected. European uncertainties may become more apparent in the next few months during the U.S. election season.