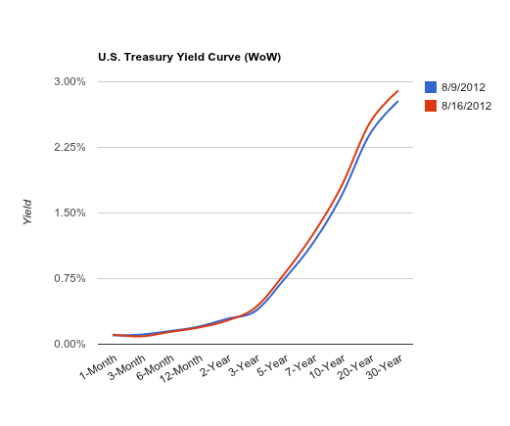

Treasury Yield Curve Adjustments

August 16, 2012 Leave a comment

Yields steepened over the week with long duration yields rising on signs that the U.S. economy is healing. I find this highly improbable as I am a bear of the stock market, i.e. Money will flee to safe assets such as U.S. Treasuries.

This morning’s job’s continuing claims number did not completely tarnish the demand for U.S. treasuries, however I believe that the employment numbers are accurate for a few reasons. The Department of Labor and the BLS constantly revise their numbers shortly after they are released, as well as exclude important factors such as parts of the workforce that have given up looking for work and the underemployed.

The treasury should gain traction as Germany, one of the safest assets on the planet, is facing a possible bailout request from Spain. I will be keeping my out out for any yield curve shifts during the next few months with the coming elections. I believe that the elections will be a pivotal event and key names have speculated that QE3 would not happen before the election is over.